Five construction and architecture economists assembled for a recent forecast of the construction economy agreed thereŌĆÖs increasing reason for gloom over the next year as the pace of growth in construction spending in the U.S. is expected to slow, stalled by cracks in the commercial real estate sector.

Ken Simonson, chief economist for the (AGC), predicted likely steep drops in multifamily, warehouse and office in the medium term as vacancies and costs climb, while Kermit Baker, chief economist with the , said there is concern the commercial sector may be in for a broader ŌĆ£meltdown.ŌĆØ

The overall forecast is for continued growth, but itŌĆÖs expansion wonŌĆÖt be as strong as initially thought at the beginning of the year.

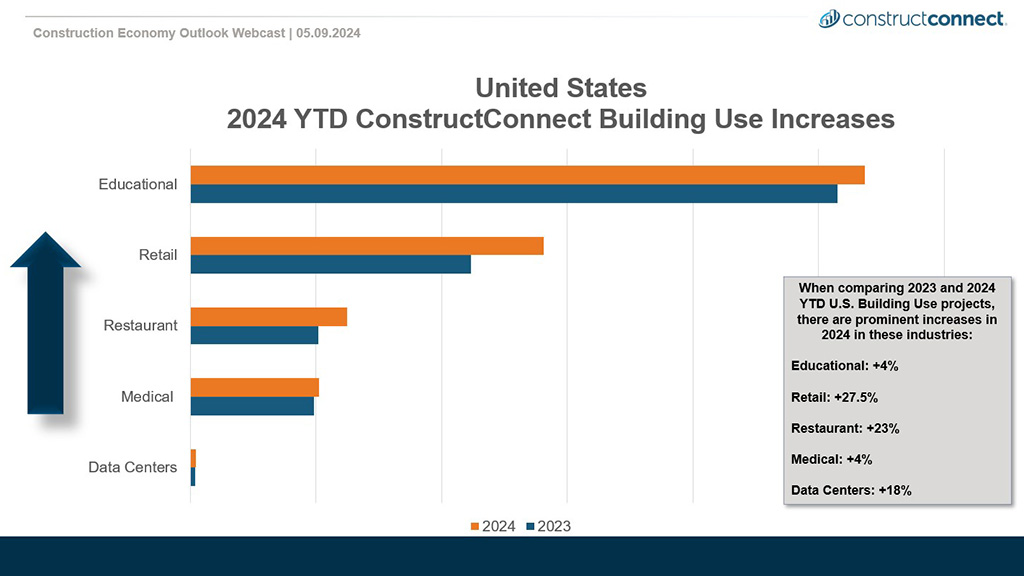

senior economist Michael Guckes said todayŌĆÖs spotty construction economy landscape has many bright spots, but investors and contractors need to know where to look.

ŌĆ£Where or how you play in the construction market is going to provide you a very different experience this year depending on where you’re playing,ŌĆØ he said.

ŌĆ£Our audience needs to be careful and consider how they’re picking their verticals. Or better yet, pick multiple subcategories or verticals that you want to serve in order to reduce some of this business risk and some of the volatility.ŌĆØ

╠²

Project stress levels spike

The May 9 webcast was billed as a ┬ķČ╣┤½├ĮĖ▀ŪÕion Economy Outlook: What is Normal Anymore. The event was a collaboration between the AIA, AGC and ┬ķČ╣┤½├ĮĖ▀ŪÕConnect and focused mainly on U.S. construction with a few forays into the Canadian market.

Guckes reported project stress conditions are now 30 per cent above 2021 levels. Higher-for-longer interest rates will act as a drag on construction, impacting overall near-term demand, he said, and suggested construction investors looking to diversify should avoid interest-rate-sensitive markets.

Instead, Guckes said, look to reshoring and national security projects, energy and electrification projects and civil works.

Baker pointed to a half-dozen factors threatening the commercial real estate (CRE) market, including:

ŌłÖ commercial property values have declined 13 per cent since mid-year 2022, and offices 24 per cent

ŌłÖ 30 per cent of paid workdays now involve remote work, a share that seems ╠²to have stabilized

ŌłÖ national office vacancy rates are approaching 20 per cent according to MoodyŌĆÖs, an all-time high

ŌłÖ almost half of office leases signed before 2020 havenŌĆÖt yet expired.

ŌĆśHavenŌĆÖt seen the bottomŌĆÖ

As CRE loans come due, Baker said, owners will be forced to refinance at higher interest rates.

ŌĆ£We haven’t really seen the bottom,ŌĆØ said Baker. ŌĆ£Many office leases have not yet come due. In the current environment they will be quite shocked as they do.ŌĆØ

Reporting on the AIAŌĆÖs billings index, Baker noted architectural firm billings have been generally weak since Q3 2022, but have been more volatile recently. New design contracts and inquiries have also flattened, suggesting billings are unlikely to rebound anytime soon, he said.

The multifamily residential sector is a weak link, said Baker.

Simonson said other sectors poised for growth are data centres, manufacturing construction and single-family homebuilding. Inflation remains ŌĆ£sticky,ŌĆØ with materials such as concrete showing unpredictability.

Summing up, he said, ŌĆ£Economic recovery will continue through this year. But I also think interest rates are going to hang in close to current high levels.

ŌĆ£The biggest challenge for contractors will continue to be labour availability.ŌĆØ

Guckes offered a contrast between forecasted growth in various sectors for 2024 now compared to the beginning of the year. For multifamily, the outlook was at 6.4 per cent and now it’s at 0.1 per cent. Total non-residential building was projected to be at 3.3 per cent at the beginning of the year and now itŌĆÖs at plus two per cent.

On the Canadian side, Guckes said, the grand total outlook is now negative 4.4 per cent.

ŌĆ£That is significantly down from our nearly eight per cent outlook that we had at the start of the year,ŌĆØ he said, blaming the drop in part on a crash in the total engineering outlook.

┬ķČ╣┤½├ĮĖ▀ŪÕConnect chief economist Alex Carrick suggested construction investors pay attention to regions of population growth across the continent, particularly the U.S. south. Last year residential construction starts in Texas measured by dollar volume were almost double the residential starts in California.

Continuing the theme, looking north of the border, Carrick pointed out the tremendous growth in the population of Toronto. The latest data shows the cityŌĆÖs population is now 93 per cent of the combined size of the next two cities, Montreal and Vancouver.

ŌĆ£There’s three cities in North America where the annual increase in population in the last couple of years has been 100,000 or more. If you think about an increase of 100,000, that means a lot of construction,ŌĆØ said Carrick.

Follow the author on X/Twitter .

Recent Comments

comments for this post are closed