Environmental, Social and Governance (ESG) monitoring, measuring and reporting are becoming a complex topic for the construction industry due to the ongoing evolution of regulations.

Canada is taking a consultative approach to ESG standards, largely reflecting the climate-change-related disclosure standards published in 2023 by the International Sustainability Standards Board (ISSB) known as IFRS S2. These came into force on Jan. 1, 2024.

The Canadian Sustainability Standards Board (CSSB) published its proposed climate-related disclosure standards (CSDS 2) on March 13. A comment and consultative period closes on June 10.

Finalization is proposed for Q3 2024. Rules would come into effect in 2025, although not binding on Canadian companies until adopted by the Canadian Securities Administrators (CSA), or unless required under other Canadian legislation or regulatory requirements.

For example, the CSA has signalled it intends to require federally regulated financial institutions in Canada, like banks and insurance companies, to start ESG reporting in fiscal year 2024. Facilities involved with the production of cement, aluminum, iron and steel are already required to report their GHG emissions under federal legislation, if greater than 10 kilotonnes of CO2 equivalents.

Additional requirements reflecting Canadian circumstances may be introduced over time by the CSSB, write a group of Torys LLP authors.

Otherwise, voluntary reporting is expected for the time being.

ŌĆ£The CSSB standards being developed in co-ordination with the ISSB do not introduce a mandatory reporting requirement for companies of any size,ŌĆØ Melanie Cole, a partner with Aird Berlis LLP, told the Daily Commercial News.

ŌĆ£Given the voluntary nature of this type of measurement and reporting currently, most companies choosing to measure and report in accordance with a particular framework are larger entities (including those that are publicly traded and already subject to certain mandatory disclosure rules relating to specific ESG matters).ŌĆØ

Cole adds, ŌĆ£My expectation is that if the standards were to become mandatory that this would only apply to larger entities at first instance.ŌĆØ

While smaller private companies may be spared from near-term ESG reporting requirements, integrating sustainability into a business strategy can better position a company for potential regulation in the future.

Cole writes identification and evaluation of potential ESG risks and opportunities associated with an investment or acquisition is becoming increasingly important and can have a substantial impact on key deal terms. It can also create business value in the long-term by informing investors, clients and colleagues of the companyŌĆÖs efforts.

At the same time, caution is advised when relying on any statements made by third parties due to verification concerns, Cole said.

ŌĆ£If an entity chooses to rely on statements made by third parties, it should make it very clear in the report that it is doing so, and also make it clear that those statements have not been verified or substantiated by the reporting party.ŌĆØ

Avoiding statements that could be construed as ŌĆ£greenwashingŌĆØ is also important, Cole said.

ŌĆ£My simple advice to companies in all sectors, including construction, is to ensure that any statements are factual, balanced, non-promotional and substantiated.ŌĆØ

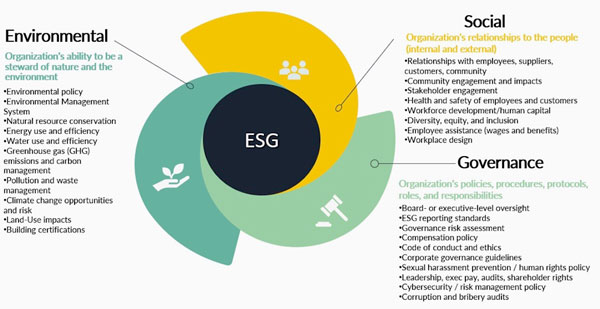

For example, the umbrella term ŌĆ£sustainabilityŌĆØ is heard repeatedly in the ŌĆ£EŌĆØ (Environmental) aspect of ESG conversations.

ŌĆ£What the term ŌĆśsustainableŌĆÖ will mean for a particular company in the construction sector will depend on many factors, including the entityŌĆÖs size, sophistication and role within the sector and on a particular project,ŌĆØ Cole said.

In construction, it could include using recycled materials, protecting natural habitats, conserving water and using energy efficient equipment and practices during construction. These need to be monitored, measured and reported in terms of improvement over previous behaviour.

When it comes to construction, the best authorities on ESG reporting suggest companies be prepared.

ŌĆ£ESG reporting is a continuing journey,ŌĆØ says global administrative services firm TMF Group. ŌĆ£Preparation of ESG reports involves co-ordination across a large number of internal and external resources.ŌĆØ

Help is out there for those who need it.

ŌĆ£There are numerous entities across the ESG space providing everything from standards, goals and guidance to company-level assessments,ŌĆØ says international consultancy Ernst & Young Global Limited. ŌĆ£Setting goals, establishing what to measure, identifying which metrics to compile and ensuring that everything is done in a way that complies with standards is a challenging process.ŌĆØ

Gathering the necessary data without frameworks based on industry standards and trained people in the reporting chain will be challenging for small and medium-size companies. Developing a plan will be critical.

Writing for Forbes, Tommy Linstroth, founder and CEO of Green Badger, a SaaS platform provider, suggests construction companies consider several steps when planning their ESG approach. These include: effective communication throughout the companyŌĆÖs network of employees, customers, suppliers and investors; the adoption of company-specific data collection and reporting processes; and the building of internal expertise through training.

More construction projects are likely to come under scrutiny from those seeking details on their environmental impact. Global insurer Marsh McLennan warns that, ŌĆ£Contractors unable to demonstrate their ESG strategy may put the sustainability and resilience of their business at risk.ŌĆØ

Recent Comments

comments for this post are closed